crypto tax calculator canada

Discover how much taxes you may owe in 2021. Adjusted cost basis and superficial losses Canada Pooling with same-day and 30-day rules United Kingdom Spot pricing for more than 20000 trading pairs.

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Ultimate Crypto Tax Guide.

. Ad Find the Next Crypto Gem on KuCoin1 Out of 4 Crypto Holders Worldwide Is with KuCoin. Koinly is compatible with Canadas tax laws and regulations and if you have a paid plan you can print tax reports including an income report capital gains report and a buysell report. Up to 500 USDT in bonuses for new users Trade Anytime Anywhere.

However it is important to note that only 50 of your capital gains are taxable. Download Schedule D Form 8949 US only Reports and software imports eg. BitcoinTax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes.

You can find your Federal and Provincial Income Tax rates in the tables above. Check out our free and comprehensive guide to crypto taxes. Heres an example of how to calculate the cost basis of your cryptocurrency.

Automated Crypto Trading With Haru. Simply copy the numbers into your annual tax. Mining staking income.

We support for 300 exchanges 10000 cryptocurrencies. 3 Cointelli Cointelli is the next-generation cloud-based crypto tax preparation software developed by Mark Kang the CEOco-founder and a CPA. As another example suppose you sell that Ethereum for 4000 in Bitcoin and then use that 4000 of Bitcoin to buy a new car.

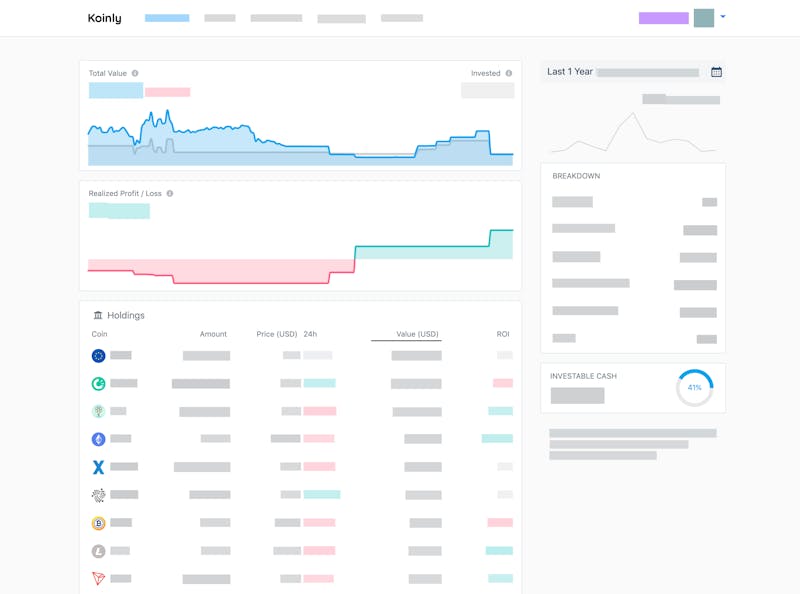

I mostly just use Koinly to find the market values at the time of my transactions and to have the value of my portfolio on my phone using the Android app. Koinly is a free-to-use crypto tax calculator that can help you file your crypto taxes in Canada. It can calculate tax incidence on crypto buying and selling transactions DeFi margin trading etc.

Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. Paying taxes on cryptocurrency in Canada doesnt have to be a headache. By the time you buy your new car however Bitcoin has collapsed and you sell your holdings for.

Whatever method you use make sure you double check that everything is being calculated correctly. You can use crypto as an investment as a currency for spending or as a source of passive income. Take the initial investment amount lets assume it is 1000.

Adjusted cost base ACB Canada Share pool United Kingdom. A simple way to calculate this is to add up all your capital gains and then divide this by 2. Are you prepared for tax season.

Get help with your crypto tax reports. The Senate reviewed the issue of taxation on cryptocurrency in 2014 and recommended action to help Canadians understand how to comply with their taxes which the. Crypto tax calculators are essential for every trader and throughout this article we will cover the best crypto tax calculators and talk in-depth about crypto taxing.

How is Cryptocurrency taxed. The total gifts can be up to 75 per cent. To calculate tax on crypto-to-crypto transactions you have to calculate the value of each crypto in fiat.

Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity. Taxes on Crypto. Your tax authority wants to know your equivalent profits or losses in the local fiat USD GBP AUD or CAD.

Calculate and report your crypto tax for free now. The amount of the provisional tax credit is determined by where you live. The source data comes from a set of trade logs which are provided by the exchanges.

The resulting number is your cost basis 10000 1000 10. In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes. File your crypto taxes in Canada Learn how to calculate and file your taxes if you live in Canada.

Crypto taxes in Canada are confusing because there are so many use cases for crypto. Simply upload or add the transaction from the exchanges and wallets you have used along with any crypto you might already own and well calculate your capital gains. It has been implemented with a new algorithm that enables the system to support accurate NFT tax calculations.

Bitcoin Tax Calculator for Canada. Straightforward UI which you get your crypto taxes done in seconds at no cost. When it comes to Income Tax youll take the fair market value of the crypto in CAD on the day you received it and apply your Federal and Provincial Income Tax rates to the entire amount to calculate how much Income Tax youll pay.

TurboTax TaxACT and HR Block desktop 1000. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins. Learn more about cryptocurrency taxes.

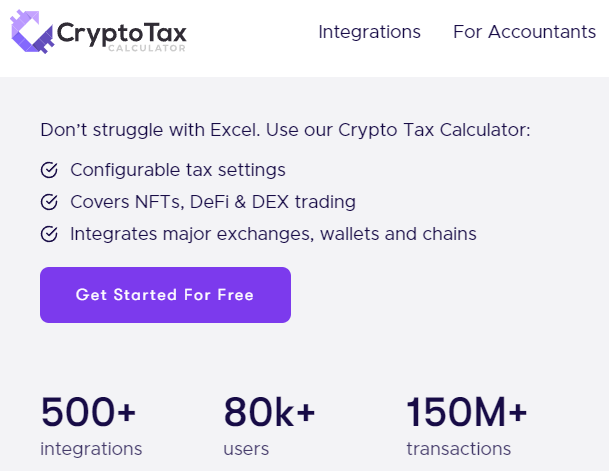

All blog post Tag. Generate complete tax reports for mining staking airdrops forks and other forms of income. Crypto Tax Calculator.

View your market value investment performance and portfolio allocation in real time and for tax purposes. Guide for cryptocurrency users and tax professionals. And for US residents these are the most important forms that your calculator should support.

The federal credit is 15 of the first 200 in donations and 29 of all subsequent gifts. Report crypto on your taxes easily using Koinly a crypto tax calculator and software. Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations.

Koinly is the only cryptocurrency tax calculator that is fully compliant with CRAs crypto guidance. A tool to calculate the capital gains of cryptocurrency assets for Canadian taxes. For the amount of work Im doing I might as well do it all myself.

Now that you are clear on how to use our crypto tax calculator and what taxes you will pay on crypto consider how. Learn how to import your crypto tax reports to TurboTax. Incur capital gains and capital losses on your crypto investments.

We unify your transaction history across every crypto service and make it searchable and filterable. Which is the best Crypto Tax Software. 10 hours agoThere are tax benefits available for charity donations at provincial and federal levels so select a good cause and contribute your bitcoin.

Tax Professional Suite. The adjusted cost base ACB is used to calculate the capital gains.

Federal Reserve Governor Talks About Crypto Market Volatility Https Bit Ly 2ukb8ts Instagram Photo Instagram Wonder

Master Crypto Triangular Arbitrage With Coygo S New Trading Bot Arbitrage Trading Master Solutions

Pin On Income Tax Calculators Net Income Calculators

Crypto Tax Calculator Review May 2022 Finder Com

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Capital Gains Tax Calculator Ey Global

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Calculate Your Crypto Taxes With Ease Koinly

Switzerland Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Best Crypto Tax Software 10 Best Solutions For 2022

Crypto Tax Prep We Help You Save On Taxes Kpoinly Koinly

Best Crypto Tax Software 10 Best Solutions For 2022

Altcoin Calculator 1 000 Crypto 31 Fiat Currencies Script Website Fiat

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

Crypto Tax Calculator India Income Tax Calculation On Cryptocurrencies Nft Explained Youtube

![]()

Crypto Tax Calculator Cointracking Info Rolls Out Ease Of Use Upgrades Ethereum World News